Bussiness

Stocks sink after weak GDP data, Meta’s miss

CFRA Research senior equity analyst Angelo Zino reacts to Meta’s Q1 earnings report, the ‘Magnificent 7’ and shares his expectations for the overall earnings period.

Stock investors kicked into selling mode after the U.S. economy posted subpar growth in the first quarter.

The Dow Jones Industrial Average fell by triple digits, with the S&P 500 and tech-heavy Nasdaq Composite also seeing sharp pullbacks in early trading.

IBM, Caterpillar and Microsoft – which reports earnings after the close of trading – paced the Dow’s steep drop, while Merck, Coca-Cola and Apple rose. Google parent Alphabet and Intel will also report results later today.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| IBM | INTERNATIONAL BUSINESS MACHINES CORP. | 166.81 | -17.20 | -9.35% |

| CAT | CATERPILLAR INC. | 337.17 | -26.32 | -7.24% |

| MSFT | MICROSOFT CORP. | 393.19 | -15.87 | -3.88% |

| MRK | MERCK & CO. INC. | 130.80 | +3.79 | +2.98% |

| KO | THE COCA-COLA CO. | 61.80 | +0.23 | +0.38% |

| AAPL | APPLE INC. | 169.03 | +0.01 | +0.00% |

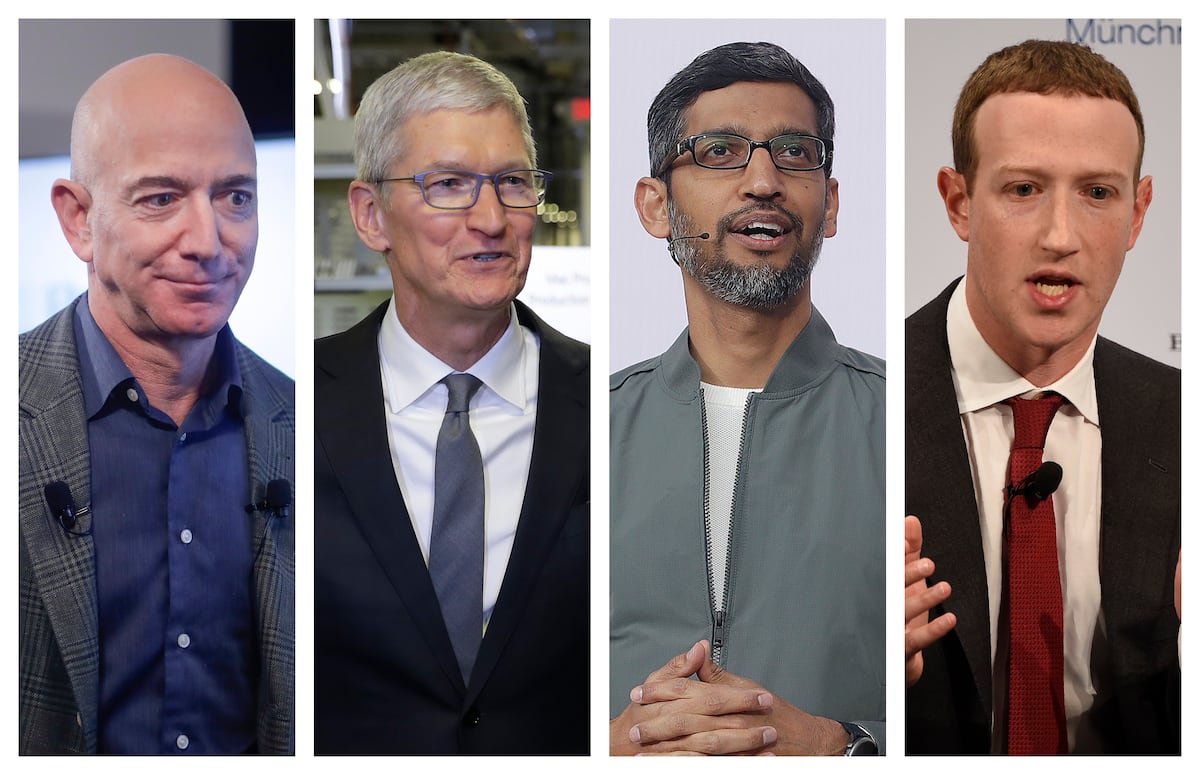

Mark Zuckerberg’s Meta sank more than 14% after weaker-than-expected revenue coupled with rising spending on AI that could push expenses near $100 billion, the company disclosed on Wednesday.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| META | META PLATFORMS INC. | 439.29 | -54.21 | -10.98% |

The Dow’s drop pushes it further away from its record close of 39,807 reached in late March 2024.

Dow Jones Industrial Average

Gross domestic product for 2024, so far, rose by 1.6% according to the Commerce Department, falling short of the 2.4% expected by economists. Although this is the seventh straight quarter of growth, it trails the 3.4% rate for the fourth quarter of 2023.

Gains in consumer spending were muted by “decreases in motor vehicles and parts as well as gasoline and other energy goods,” the Commerce Department said.