Bussiness

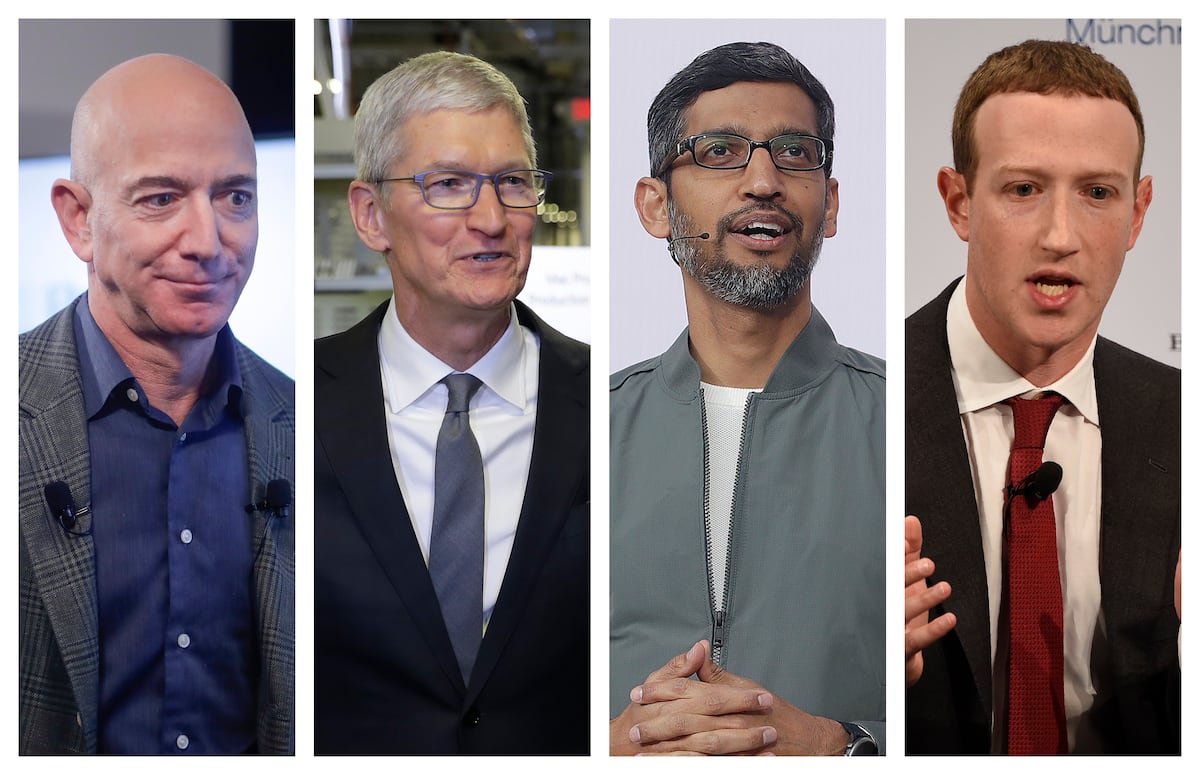

Tech companies break earnings records despite regulatory battle

The dominance of tech companies is growing despite regulatory pressure. Authorities in the United States and Europe have launched an offensive to end monopolistic practices that they consider illegal. But meanwhile, the digital giants are growing larger and larger as bankable entities, nourished by the new golden goose of artificial intelligence. Profits at Alphabet, Apple, Amazon, Microsoft and Meta shot up 38% in the first quarter to $92.037 billion.

The five big tech companies have been joined by Nvidia, which operates on an irregular fiscal calendar and will present its February-April earnings report on May 22 and is also expected to evidence record-breaking sales and profits. Those six companies add up to a stock market value of $13 billion and have reached all-time trading highs, backed by their performance.

Apple enjoys a vast market share in high-end smartphones; Google is without rivals as a search engine and in online advertising; Amazon dominates e-commerce; Microsoft, operating systems; Meta has an enviable position within social media with Facebook, Instagram and WhatsApp; while Nvidia holds a new monopoly in high-powered processors. Each one is sucking the juice out of its respective market, and continues to add new divisions.

Another similarity is that all six firms are working with artificial intelligence, which requires high levels of investment to maintain market position. Microsoft leads the pack, thanks to its alliance with OpenAI. Not just its cloud computing business has benefited — it is also incorporating levels of artificial intelligence to its products. Alphabet, which was caught off-guard by generative artificial intelligence, is making up the ground it lost at a rapid pace in its server business. Amazon was a pioneer in identifying cloud data and computing as big business, but it is also taking advantage of artificial intelligence among its commercial offerings, inventory management and even route optimization. Meta has seized on AI to better hook users on its social platforms and to improve its ad management. Apple is a wildcard, having fallen behind in generative artificial intelligence, but it does incorporate certain functions and apps in its products and services that feed off of AI. Nvidia, which counts the other firms as clients, has been the greatest beneficiary of the new technology’s gold rush.

Alphabet, profit leader

The only firm that did not break records in the first quarter was Apple. A drop in iPhone sales and supply chain delay in Chain has hobbled sales, which fell 4% to $90.753 billion, and profits, which dropped 2% to $23.636 billion. The company is facing regulatory pressure related to its app store and a lawsuit over illegal monopolistic practices in the United States smartphone market. The Department of Justice has accused the company of protecting the iPhone’s dominant position by closing off its technological ecosystem to competitors.

Tim Cook’s Alphabet has become a profit leader at $23.662 billion, 57% higher thanks to a 15.4% growth in sales stemming from improvements in marketing and server growth. The company headed by Sundar Pichai has received multimillion-dollar sanctions from the European Union and faces two lawsuits from the U.S. Department of Justice. One, regarding the search engine market, is set to be ruled on next Friday in Washington D.C. Another, related to digital advertising, is working its way through the courts. For its part, Amazon leads in sales, with a $143.313 billion growth that equals a potent 12.5% increase. Its profits have tripled to $10.431 billion. E-commerce business accounts for the bulk of CEO Andy Jassy’s company, but cloud computing and advertising business (on its commercial platform and streaming service) have also become primary motors for its growth. The Federal Trade Commission (FTC), directed by Lina Khan, has accused Amazon of monopolistic practices that “inflate prices, degrade quality, stifle innovation for consumers and businesses.”

Sales and profits at Microsoft grew more than expected, driven by business demand for its cloud and AI services. Profits at the company led by Satya Nadella rose 17% to $61.858 billion in the first quarter of the calendar year, equal to a third of its fiscal year. Net income was $21.939 billion, an increase of 20%. After overcoming obstacles to its purchase of Activision, its alliance with OpenAI is now under the scrutiny of both the Department of Justice and the FTC.

The only poor showing on the market came from Meta, but not due to numbers, per se. Sales at the company that was founded and is run by Mark Zuckerberg shot up in the first quarter by 27% to $36.455 billion. Still, after its 2023 austerity exercise, it spooked the market by raising its spending and investment estimates based on AI. Its second quarter forecast was also disappointing. Aside from its lawsuits over the impact of social media on minors, the FTC sued Meta in 2021, accusing it of reducing competition with its purchase of Instagram and WhatsApp, and that process is still underway. The FTC wants that to go to court this year.

For now, neither fines, nor lawsuits, nor investigations, nor regulatory change have been able to slow the unstoppable growth of the tech giants, which have become digital age monopolies thanks to the innovation and global success of their goods and services. They’re all competing for their slice of the AI pie.

Sign up for our weekly newsletter to get more English-language news coverage from EL PAÍS USA Edition