Travel

Mastercard’s New App Embraces Virtual Card Trend in Corporate Travel

Skift Take

Mastercard knows it’s not the only player in the world of mobile virtual cards. With its new app, Mastercard wants to stand out as an MVP in streamlining corporate travel while serving a wave of companies adopting this innovation.

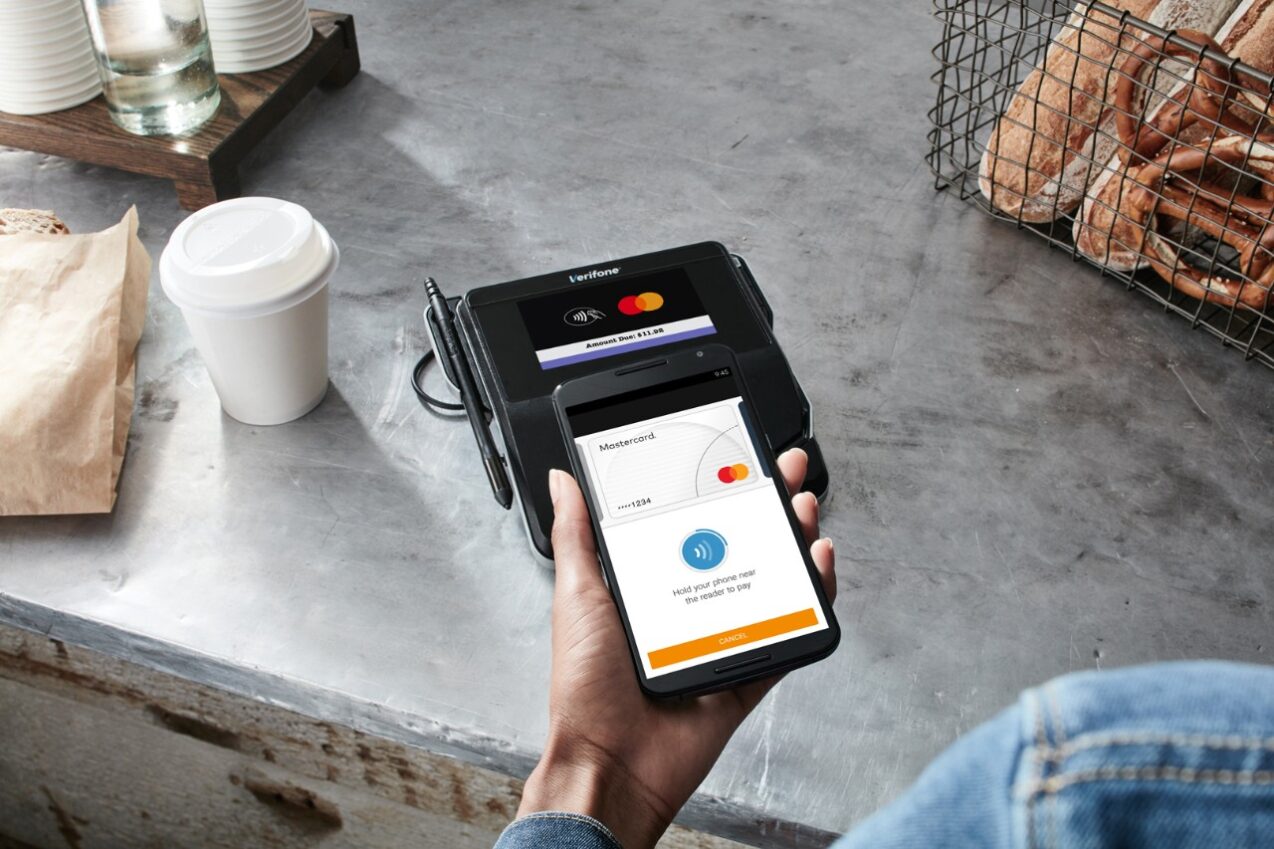

Mobile virtual cards aren’t new. A virtual card assigns a unique number to a transaction or a specific period of time. Companies can set spending controls on these card numbers so that employees don’t go over a limit. You can store these virtual cards on your phone.

But what is new is that Mastercard and other players are making these cards easier to access in digital wallets on employee phones.

Mastercard on Thursday announced a mobile virtual card app. Skift wanted to understand how this move fits into the broader evolution of corporate travel. So we spoke with Mastercard’s global head of commercial solutions, Chad Wallace. Here are some takeaways:

Why does this matter?

Mastercard says its new app could help streamline corporate travel expenses. Here’s some backstory, first:

Not everyone at a company needs “the corporate card,” especially those who don’t travel often. But, when an employee gets ready for their first conference trip, things can get hazy.

Let’s say an employee is a recent grad who’s cash-strapped. They plan to submit a tedious expense report after the trip but dread waiting for reimbursement.

Mastercard thinks it has a fix. The company will launch an app to consolidate mobile virtual cards, aiming to reduce the stress of business travel.

“Think of a candidate who is coming in to travel for an interview for a job,” Wallace said. “Rather than that candidate having to pay out of pocket and then submit their expense report to the organization that they’re interviewing with, a mobile virtual card could be issued to the candidate for a period of time, allowing them to charge their travel to the central account.”

Dodging a lengthy reimbursement process could be especially nice if the applicant doesn’t make the cut. Ouch.

Mobile virtual cards create a clear paper — or virtual — trail.

“Having that single card attached to the trip has been great from a reconciliation perspective because then you can really see the person booked a trip, there’s a booking record locator number on that, and then you’ve got a specific payment instrument that’s tied to that,” Wallace told Skift.

Who can use this right away?

The first financial partners to offer the wallet are Australian banks — HSBC Australia and Westpac. Why is that? What does this mean for companies that rely on other banks?

This geography is strategic. Wallace estimated that roughly half of the world’s digital wallets are based in Asia–Pacific.

“A lot of those consumers on their regular consumer card are using tap-to-pay in order to transact,” Wallace said. “We thought that that was a great location in order for us to first get started.”

Still, Mastercard’s 2023 research indicates 92% of those deciding on travel are curious about making virtual cards accessible for business trips. Following the pandemic, corporate travel is booming around the world. Last year, the Global Business Travel Association anticipated 32% growth in business travel spending.

Seeing this demand, Wallace said Mastercard plans to go global with the wallet within the course of this year.

What are the benefits for businesses?

How does the app integrate with the expense management and booking software that many companies rely on?

Wallace said Mastercard hopes to work with booking and expense management companies to generate cards at the point of booking. Collaborations would allow a mobile virtual card to be created and then closed out right after its use, avoiding any excess spending.

What security measures does the app provide?

To protect the cards, Mastercard’s app users can establish biometric authentication and a personal identification number. The digital wallet uses tokenized cards, providing another layer of security.

What’s next?

Mastercard is delving deeper into the mobile virtual card game by rolling out its new app. With such a big company involved, what does that say about the future of mobile virtual cards in corporate travel?

Wallace believes Mastercard’s product speaks to the widespread adoption of virtual cards, mobile or not.

“I just think it reinforces the fact that virtual cards are here,” Wallace said. “They’re drastically growing overall.”